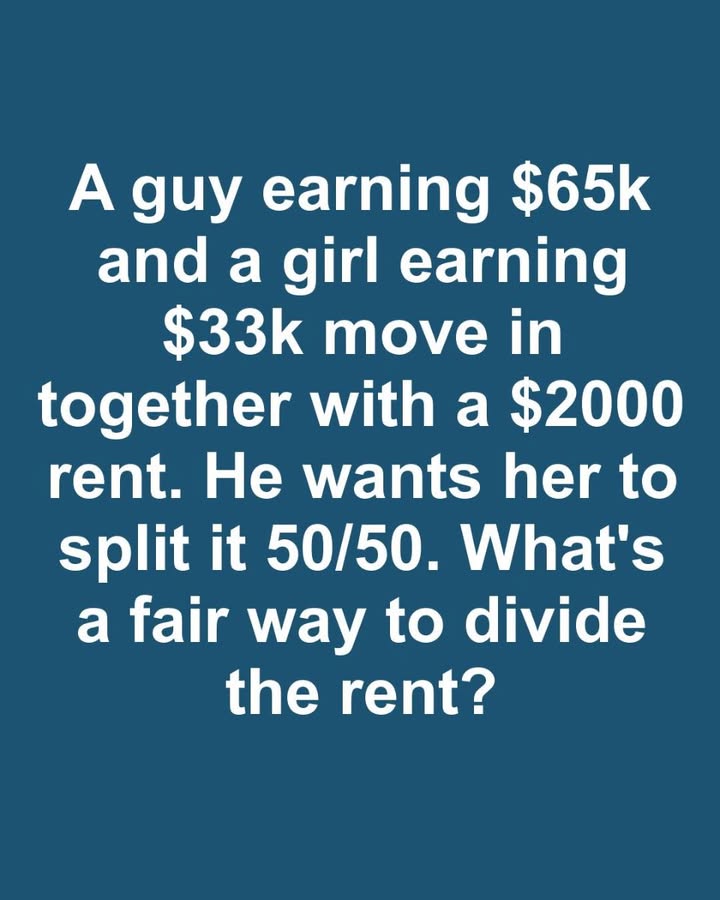

When a couple decides to move in together, it’s often an exciting milestone in their relationship—but with that new chapter comes a variety of practical challenges, especially when it comes to managing money. One of the most common issues couples face is figuring out how to fairly divide the rent, particularly when their incomes are significantly different.

Take, for instance, a scenario where one partner earns $65,000 annually and the other earns $33,000. With a monthly rent of $2,000, how should they split the cost in a way that feels fair to both parties? While splitting it 50/50 might seem like the most straightforward approach, it doesn’t always reflect the reality of each person’s financial situation. Income disparity is not uncommon among couples, and when not addressed thoughtfully, it can lead to tension, resentment, or even long-term financial strain for one partner. That’s why it’s so important to consider alternative methods that are equitable rather than simply equal.

One practical method is to divide rent proportionally based on each person’s income. In this example, the person earning $65,000 contributes about 66% of the total household income, while the one earning $33,000 contributes around 34%. Applying those percentages to the $2,000 rent, the higher earner would pay $1,320 and the lower earner would pay $680. This way, each person is contributing in line with what they can realistically afford, which often feels more fair than splitting things right down the middle. Another approach is for each partner to contribute a consistent percentage of their income toward rent.

For instance, if both agree to contribute 30% of their income, then the partner earning $65,000 would pay about $1,625 per month, while the one earning $33,000 would pay around $825. This method takes a little more math upfront but helps ensure that neither partner feels financially overburdened. It creates a sense of balance without demanding identical contributions. A third option is to split rent evenly but adjust for fairness by dividing other shared expenses differently. For example, if rent is shared equally, the partner earning less could contribute less to utilities, groceries, or entertainment costs—or perhaps take on more of the household chores as a non-monetary contribution. This strategy only works if both partners are transparent about their budgets and willing to communicate openly about their responsibilities.

Regardless of the method chosen, the foundation of any successful shared financial plan is honest and open communication. It’s essential for both people to be upfront about their incomes, debts, and monthly obligations so that no one feels like they’re carrying an unfair portion of the financial weight. These conversations can be uncomfortable, but they’re necessary to avoid misunderstandings and resentment later on. Rent is only part of the bigger picture. Couples should also consider how they’ll handle additional household costs like electricity, internet, groceries, cleaning supplies, and any other regular expenses. Putting together a shared budget that includes all of these costs can help ensure that both individuals are contributing fairly to the household and that no one feels like they’re constantly picking up the slack. Money issues are a common source of stress in relationships, and when one partner feels like they’re doing more than their fair share, that stress can build up quickly. That’s why it’s so important to come to an agreement that feels sustainable and respectful to both people involved. Proactively addressing financial issues and agreeing on a system that works can actually strengthen a relationship by fostering trust, communication, and mutual respect. In addition to financial planning, cohabiting couples should also be aware of any legal implications. Even if you’re not married, living together can create shared financial obligations or property disputes if things don’t work out. A cohabitation agreement—a legal document outlining each partner’s responsibilities and rights—can provide protection and clarity for both parties. In the end, there’s no single “correct” way to divide rent between partners with unequal incomes. The most important thing is to choose a method that both people believe is fair, whether that’s a proportional contribution, an equal percentage, or balancing expenses in other areas. What matters most is that both partners feel heard, respected, and comfortable with the financial arrangement. With empathy, communication, and flexibility, couples can create a living situation that supports their relationship and keeps their home life harmonious.